India’s investing landscape has changed considerably in recent years. Digital-first platforms have made investing easier and cheaper, giving investors more options than ever. The rise of the zero brokerage demat account has attracted regular investors by eliminating trade brokerage fees. The popularity of digital platforms like option trading app India has made online portfolio management easier for traders and investors.

If you invest in mutual funds, should you utilize a zero brokerage demat account or are there other options? Break this down carefully.

Understanding Zero Brokerage Demat Accounts

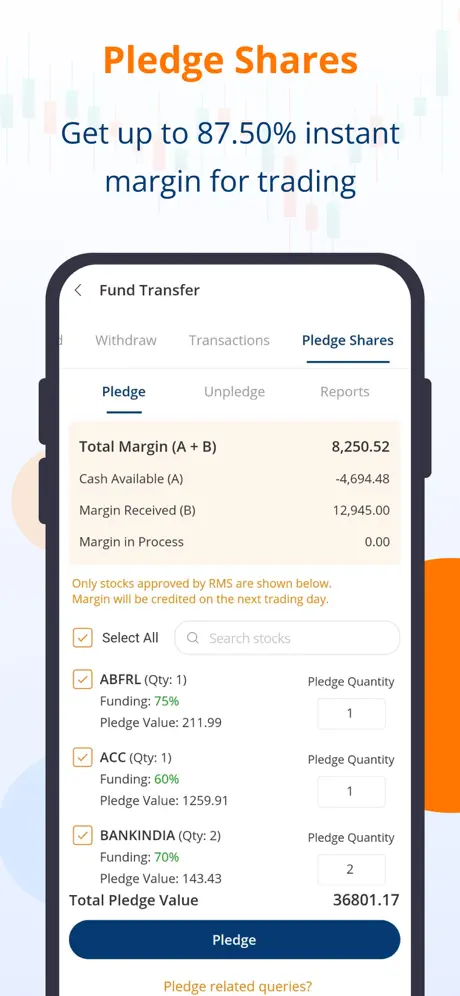

Demat accounts let investors keep financial securities electronically instead of share certificates. In a zero brokerage demat account, the platform waives brokerage charges on equity delivery trades and increasingly mutual fund purchases. These accounts appear efficient and cost-effective for investors trading equities or derivatives through an option trading app India.

Such systems let you manage many asset classes in one account and save transaction-based brokerage costs, making investing easier and cheaper.

Demat Account Mutual Fund Investment

Historically, investors bought mutual funds directly from Asset Management Companies (AMCs) or through distributors, brokers, and agents. Direct routes were cheaper since they avoided distributor commissions. However, demat accounts and online brokers allow investors to hold mutual fund units in dematerialized form, consolidating their portfolio with stocks, ETFs, and bonds.

Investors that use an option trading app India for stock and derivative trading may find this combination appealing. Tracking and managing stocks, mutual funds, and other instruments in one place simplifies investment management. This convenience has drawbacks that must be considered.

Zero Brokerage vs. Hidden Fees

Zero brokerage implies free service, however mutual funds are not free. Many brokers offering zero brokerage demat accounts allow mutual fund unit purchases as standard plans. Due to distribution fees and charges, regular plans cost more than direct plans from AMCs or specific platforms.

A zero brokerage demat account may save investors upfront transaction expenses, but normal plans’ higher recurring expense ratio reduces investment returns over time. Though slight, this difference has a lasting impact. Even a 0.5% annual expense difference can reduce wealth over decades.

Cost-Convenience Tradeoff

Investing in mutual funds with a zero brokerage demat account relies on whether the investor values convenience or cost efficiency. If you use an option trading app India to trade stocks or options, putting your mutual fund investments in the same demat account may make reviewing your complete financial portfolio easier. Log in, examine asset allocation, track performance, and manage everything from one place.

However, if you are investing in mutual funds for long-term wealth creation and not a stock or derivative trader, you should consider using platforms that allow direct mutual fund plans. Since direct mutual funds eliminate intermediary commissions, they have lower expense ratios and higher long-term returns.

Zero brokerage demat accounts save brokerage fees immediately, but these platforms’ conventional mutual fund plans have higher expense ratios, which could cost you more over time.

When is a Zero Brokerage Demat Account useful?

Investors that actively trade equities or options and want to consolidate their stocks, bonds, ETFs, and mutual funds into a zero brokerage demat account benefit most. This account can be useful if you value having one account where everything can be tracked and are less concerned with maximizing returns by cutting every cost.

If you’re only investing in mutual funds to develop long-term wealth, a direct plan with no commissions is superior. Direct programs with lower expense ratios can accumulate thousands or lakhs more wealth than demat account plans over time.

Information for Option Traders Considering Mutual Fund Investments

Option trading app India traders may find adding mutual funds to a zero brokerage demat account handy. Remember that options trading is short-term and speculative, while mutual funds are long-term. Mutual fund investment requires patience, discipline, and cost awareness, unlike active trading. Choose the right structure if you trade regularly and generate long-term wealth with mutual funds.

Conclusion:

A zero brokerage demat account might be convenient for investors who want to manage all their assets in one location or trade stocks and derivatives utilizing an option trading software India. It simplifies portfolio viewing with an integrated view.

However, zero brokerage does not mean zero expense. Many brokers provide regular mutual fund plans with greater fee ratios than direct plans, which might slowly lower your investment results.

Investors must assess their goals, portfolio, and costs before investing. Zero brokerage demat accounts are appropriate if convenience is your primary goal and you can handle higher expense ratios. Direct platforms may be better for minimizing costs and maximizing long-term mutual fund performance.

The best investing choice relies on your goals, style, and preferences. Compare platforms, define “zero brokerage,” and choose the path that best fits your financial goals.