Unexpected events abound in life; a last-minute travel schedule, a sudden auto repair, or an urgent medical bill may all throw off even the most meticulously thought out budgets. Having fast and consistent financial help might make all the difference at such times. Fast cash loans then become really important. Securing a fast money loan is now faster and simpler than it has ever been thanks to creative apps like cash bank apps and money apps. These instruments offer a lifeline in an emergency, making sure you have the money you need to negotiate life’s curveballs free from needless delay or stress.

Definition of Fast Cash Loans:

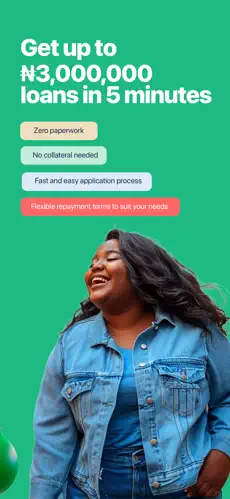

Designed to give quick access to money in an emergency, a fast cash loan is a temporary financial tool. Fast cash loans provide a simplified way to acquire money unlike conventional loans, which often need involved procedures. Easy access to these loans via user-friendly apps like a cash bank app or a money app helps you to get funds when most needed.

Why Choose Quick Cash Loans?

Fast cash loans are designed for times when urgency rules. They provide advantages including customizable loan terms, fast approvals, and no collateral needed. Platforms like money apps and cash bank apps can process your application and move money in as low as a few hours thanks to modern technology. For handling unanticipated costs such medical bills, house repairs, or last-minute vacation requirements, this ease makes them the perfect solution.

How Would One Apply for a Fast Cash Loan?

Obtaining a quick cash loan is easy and simple. First, on your smartphone, download a respectable money app or cash bank app. These tools offer detailed instructions, therefore streamlining the application procedure. The app checks your data once you supplied the necessary information and turned in your loan request. Approved, the money is sent straight into your bank account usually on the same day.

Advantages of loan money apps:

A trustworthy money app is your portal to fast financial help, not only a tool for controlling spending. These programs simplify the application process for a quick money loan, saving the necessity for bank visits. Comparably, a cash bank app provides one-stop solutions with account management, payments, and instantaneous loan access. During the financial crisis, their quickness and simplicity make them absolutely indispensable.

When should one think about a fast cash loan?

Although quick cash loans are quite handy, one should use them sensibly. For real emergencies—such as unanticipated medical bills, quick house repairs, or last-minute travel expenses—these loans are perfect. Using a money app or a cash bank app guarantees you the money you need without needless waiting. To reduce financial stress, though, you should only borrow what you can reasonably pay back.

Conclusion:

Though the curveballs of life might be difficult, a fast cash loan will enable you to easily negotiate them. Using cash bank applications and money apps will help you rapidly handle crises and manage funds free from stress. These loans are a dependable way to handle life’s erratic events, whether they are for a sudden need or a debt.